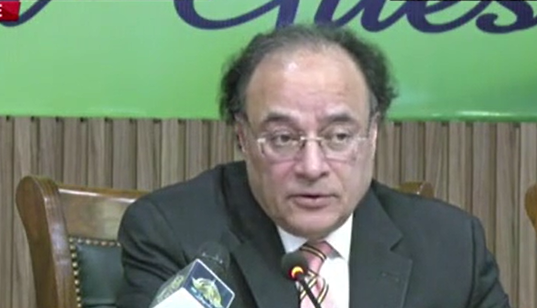

Federal Finance Minister Muhammad Aurangzeb has stated that Pakistan’s economic stability is evident to the world. He emphasized that the rising volume of imports remains a major challenge. However, he expressed hope that, God willing, this would be the last program with the International Monetary Fund (IMF) — a goal that can only be achieved if structural reforms are properly implemented.

Speaking at a budget seminar in Karachi, the finance minister remarked that the government is making every effort to withdraw from areas of business where it no longer needs to be involved. “The private sector must now drive the country forward,” he said.

Highlighting the importance of tax revenue, Aurangzeb pointed out that with a population of 240 million, the country cannot run without sufficient tax income. He noted ongoing efforts to reform the tax authority and shared that the business community has shown willingness to pay more taxes — but many wish to avoid dealing with the tax authority. “This is not feasible,” he explained, “because we are not a country of just 3 to 4 million people.”

The finance minister underscored that the government is working to reduce human involvement in the tax process by leveraging data and modern technology. This, he said, would help eliminate harassment and reduce instances where individuals try to negotiate their tax liabilities. “Such practices will come to an end,” he affirmed.

He made it clear that “the question of tax exemption does not arise.” Every sector, including manufacturing and those involved in exports and income generation, must be brought into the tax net. At the same time, he said, efforts are being made to simplify and ease the lives of salaried individuals. “For 70% to 80% of the salaried class, taxes are deducted as soon as their salaries are deposited into their accounts.”

Aurangzeb added that the aim is to ensure that salaried individuals do not need to hire tax advisors. Tax forms, he said, should consist of only 9 to 10 fields, many of which should include auto-fill options.

Discussing the energy sector, the finance minister noted that the country is moving in the right direction. Regarding taxation, he mentioned that the government had already requested recommendations from the business community back in January so they could be considered for the upcoming budget. Several trade organizations have since submitted their suggestions, and the government has also engaged independent analysts to assist — much like in other countries.

He acknowledged that since Pakistan is currently part of an IMF program, there are constraints on what can and cannot be done within the scope of the budget. “As public servants, it is our duty to approach all stakeholders for their input. These recommendations will not be discarded,” he assured.

Aurangzeb further revealed that the cabinet has approved the separation of the Tax Policy Office from the Federal Board of Revenue (FBR). The office will now report to the Finance Division. He pointed out that while businesses plan for 5 to 15 years when launching new ventures, the government currently drafts the budget on a year-by-year basis, based on estimated income and expenditure.

In conclusion, the finance minister stated that, moving forward, the Tax Policy Office will be responsible for policy matters concerning the business community, while the FBR will focus solely on tax collection. “This will be the FBR’s final year involved in policy-making during the budget process — after that, its role in this area will come to an end,” he said.

BeNewz

BeNewz