The Chairman of the Federal Board of Revenue (FBR), Rashid Mehmood Langrial, has acknowledged that Pakistan’s tax rates are flawed and need to be corrected.

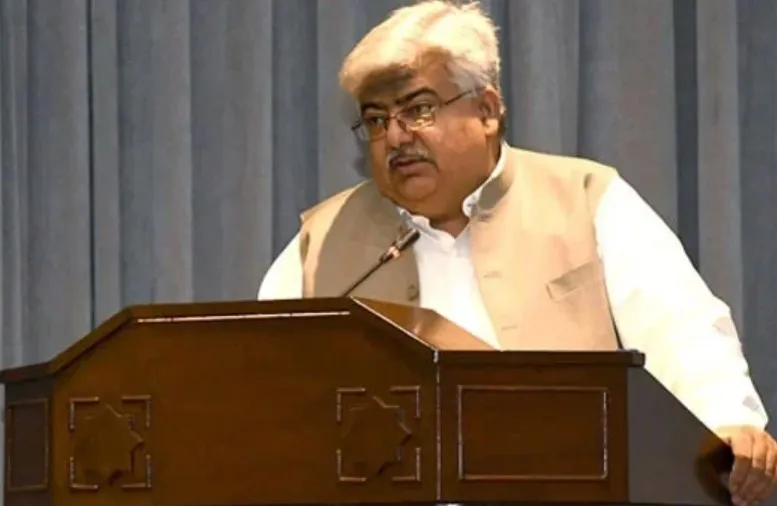

Speaking at the ThinkFest event held at Alhamra Hall in Lahore, Rashid Mehmood Langrial stated that Pakistan is a poor country where a significant portion of the population does not have taxable income. About 60% of the population earns so little that they fall outside the tax net.

He revealed that there is a tax gap of Rs 2 trillion in Pakistan. There are 4 million households with air conditioners, yet those who meet the criteria for being in the tax net are not paying taxes properly.

The FBR Chairman further elaborated that there are numerous issues on both the taxpaying and tax collection sides. The system is designed for only 5% of the population. Ironically, those who advise on how to fix the system are the ones evading taxes themselves.

He stated that the FBR aims to collect Rs 13,500 billion in taxes this year. Pakistan’s tax rates are incorrect and need to be fixed, particularly those affecting the general public and salaried individuals.

Rashid Mehmood Langrial added that Pakistan is not among the overtaxed countries. In India, sales tax on goods is managed by states, whereas in Pakistan, it is handled by the federal government.

He remarked that Pakistan’s education production system has failed. The country’s current state of education is comparable to where France was in the 1960s. However, he questioned whether Pakistan has reached the level France achieved in 1960, and concluded that the answer is no. Neither is the nation paying adequate taxes, nor is it receiving the corresponding level of services.

He said that those who should be taxed more are not being taxed effectively, resulting in the inclusion of salaried individuals in the tax net. The government acknowledges that tax rates on certain items need to be lowered.

Rashid Langrial also shared that a new law is being introduced where non-filing of tax returns will make it difficult to make purchases from income. Last year, there were 200,000 taxpayers, while this year, 600,000 retailers have entered the tax net. However, many of them have not declared their incomes.

He disclosed that the federal government has decided to shut down two ministries and several departments. The finance minister is working meticulously, with some posts already abolished and more to follow. Planned future recruitments have also been halted.

The FBR Chairman noted that there are 700 officers without adequate staff for their tasks. He emphasized that professors should be paid higher salaries so that paying taxes does not become an issue for them.

He also highlighted that smuggling of petroleum products is at its peak, and all efforts are being made to curb it.

BeNewz

BeNewz