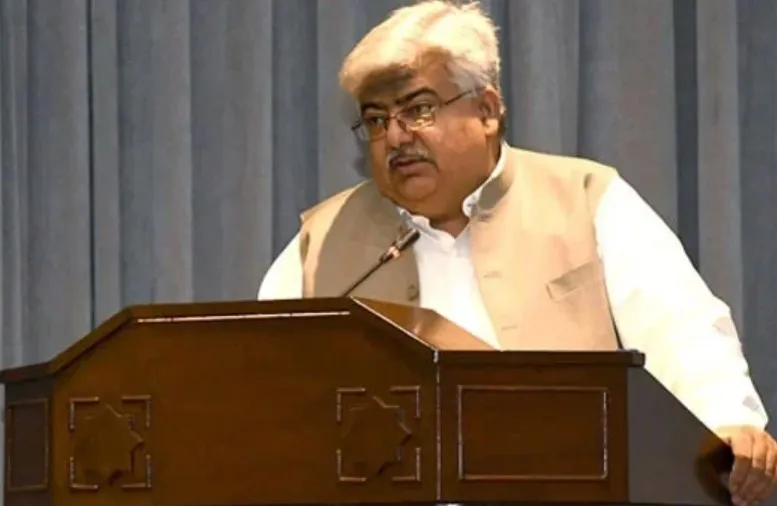

In a meeting of the Senate Standing Committee on Finance, held under the chairmanship of Senator Saleem Mandviwalla of the Pakistan Peoples Party, a significant development unfolded regarding the ongoing investigation into money laundering through the import of solar panels.

The sub-committee, established to probe the matter, requested additional time to complete its investigation into the laundering of billions of rupees under the pretext of solar panel imports.

Senator Mandviwalla responded firmly, stating that the committee could not be granted more than two months to conclude its work. In response, the Chairman of the Federal Board of Revenue (FBR) suggested that the sub-committee be reconstituted and given an extension of one additional month. Supporting this proposal, the Deputy Governor of the State Bank agreed, noting that it would be more effective to restructure the committee and allow more time for its proceedings.

Senator Mandviwalla then proposed that the sub-committee’s report be submitted to the authorities, who could provide their recommendations. Based on those recommendations, the committee would make its final decision.

Earlier, FBR officials had informed the committee that nearly Rs 106 billion had been transferred by companies under the guise of importing solar energy equipment. During the investigation, it was revealed that Rs 69 billion of this amount involved over-invoicing. Overall, the FBR identified 80 suspicious companies implicated in the solar energy import scandal. Among these, 63 companies were linked to over-invoicing activities totaling Rs 69 billion.

The FBR has filed 13 FIRs against the involved entities. Further investigations uncovered that companies such as Bright Star, Moon Light, Asadullah Enterprises, and Smart Imports were directly involved in over-invoicing practices.

In the same session, the Deputy Governor of the State Bank informed the committee that the federal government is in talks with banks to secure a loan of Rs 1,275 billion in an effort to eliminate circular debt in the power sector. Out of this amount, Rs 658 billion would be allocated for repaying debts in the power sector, Rs 400 billion would be raised through Sukuk bonds, and the remaining funds would be used to pay off other outstanding loans.

Additionally, he noted that the government plans to borrow another Rs 670 billion to meet other essential needs, with negotiations with relevant stakeholders currently in their final stages.

At this point, Senator Shibli Faraz raised a concern, questioning the duration of the proposed loan. He remarked that while the government had previously paid the interest on such loans, the burden would now fall on the public.

Committee Chairman Mandviwalla responded, stating that the government is simply transferring the circular debt from one place to another.

Later, during an informal conversation with journalists after the Finance Committee meeting, FBR Chairman Rashid Mahmood Langrial revealed that the Prime Minister has approved the abolition of the Federal Excise Duty (FED) on property purchases. He clarified that there would be no cap on property purchase values.

Langrial added that a summary has been sent for the elimination of the FED. The 3% FED currently imposed on property purchases for tax filers would be removed. Furthermore, the 5% FED for late filers and the 7% FED for non-filers would also be abolished.

BeNewz

BeNewz